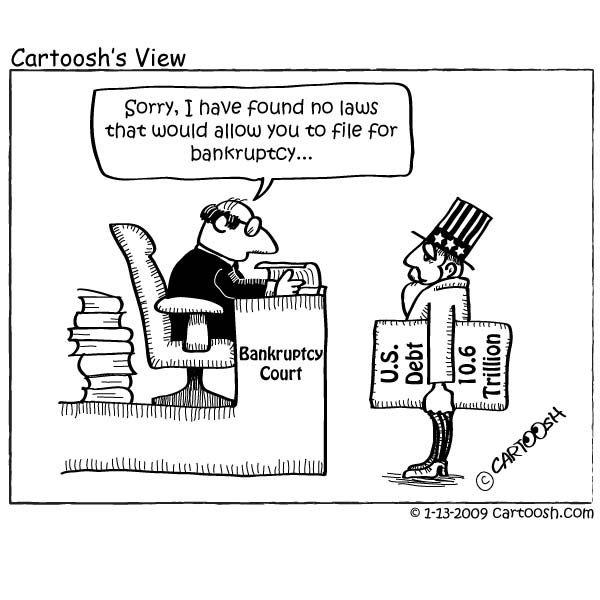

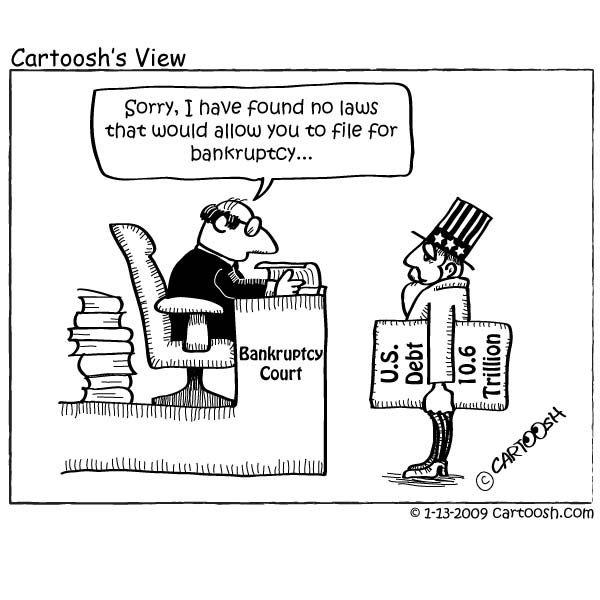

Article originally published at http://suite101.com/a/bankruptcy-and-us-student-loans#ixzz2NrNxXOZD Photo Credit: Cartoosh's View: Bankruptcy Court 1-13-2009 (The U.S. Debt Woes are not student debt woes of course, but there may be some parallels) - Cartoosh / Creative Commons - GNU Free Documentation http://commons.wikimedia.org/wiki/File:20090113_bankruptcy-01.jpg http://cartoosh.com/blog/u-s-national-debt-over-10-6-trillion

Originally, student loan debt was dischargeable in bankruptcy settlements. Obama has recently sought to revive bankruptcy options. One argument is that bankruptcy discharge can reduce college costs.

Originally it was possible to have student loan debt discharged in a bankruptcy settlement. Huffington Post's Fred Bauer (2012) says it should be possible again. Bauer argues that allowing bankruptcy will reduce college costs.

How can this work? If bankruptcy is allowed, perhaps more student loans, particularly private ones, will require co-signers. Some students of course will be unable to obtain these. Thus not as many students will be able to take extra loans to pay fees, and in theory, fees will be reduced, particularly at private college where most revenue is financial aid funds.

Current Regulations

Currently no qualified (qualified means federal loans, FFEL or Direct, or National [Perkins] loans, or any private loans certified by the school) student loans, not even private student loans made for profit, are dischargeable in bankruptcy (with exceptions made by judges for a few cases where the school was not accredited or where the filer is likely to have little or no earning power over his or her lifetime). Prior to the 2005 "Bankruptcy Abuse Prevention and Consumer Protection Act" (BAPCPA), only private student loans made by a nonprofit institution (as well as federal education loans) were excepted from bankruptcy discharge. Says Mark Kantrowitz's Smart Student Guide to Financial Aid, in 2005 Section 220 of the BAPCPA amended US Bankruptcy code to include all private student loans as well as other student loan types already included.

Bankruptcy Costs

A few student loans can still be discharged through bankruptcy, and, according to Sallie Mae's calculations, in spite of the various student loan bankruptcy prevention laws, student loan bankruptcy costs the average U.S. family about $400 per year in taxes.

History

Before the mid-1970s, all student loans were dischargeable in bankruptcy. However, beginning in the 1980s, student loans guaranteed by a non-profit guarantors were made not dischargeable. According Eileen Ambrose of the Baltimore Sun (2012), many lenders thus came to prefer non-profit guarantors. This was so even though a bankruptcy did not automatically discharge the guarantor's obligation as well, and thus the lender may be able to seek reimbursement from the guarantor even after a loan holder declares bankruptcy, according to Debra Booher and Associates Co., LPA.

Student Loans and Current Bankruptcy Codes

Thus, if you file for bankruptcy today and hold a student loan, yes collection action against you stops during your hearing (and so does collection action against any co-signers, that is, so long as you do not file for bankruptcy too often), but at the end your student loan debt must be paid in full by you or your co-signers. In addition, although collection action stops during the bankruptcy "stay," interest nevertheless accrues on your loans.

Chapter 7

Student loans cannot normally be discharged through what is called "Chapter 7 Liquidation." Under "Chapter 7 Liquidation," your assets, other than those protected in the state in which you file (protected assets generally include the home you live in and your retirement accounts) are liquidated, with the proceeds used to pay off debts. If your assets are insufficient to pay everything, your debts are still discharged, but not your student loans.

Chapter 13

If you have some income, you may be eligible to file instead for "Chapter 13 Reorganization," a bit different than filing for Chapter 7. Under Chapter 13, you can keep all assets and not just those that are protected in your state; however, income beyond an allowed amount must be used to pay off creditors. Under Chapter 13, student loans are classified as "priority debts," debts that must be paid in full. With chapter 13 bankruptcy, you tend to have three to five years to make payments according to a payment plan set by the court. If you get extra income during this period, as noted, it, in addition to the payments set by the court, must go to pay creditors. Chapter 13 payments are made to the court, and it, not you, actually pays creditors. At the end of the period, non-priority debts not paid in full are discharged, but since your student loans are priority debts, these can't be discharged. Thus you will continue to owe these, and collection actions can resume.

Bankruptcy for Private Loans?

Both the Consumer Financial Protection Bureau (CFPB) and current U.S. President Barack Obama, like Huffington Post's Bauer, advocate allowing some student loans, particularly private student loans, to be discharged through bankruptcy. Private loans are loans that may be guaranteed by a third-party agency but not by a non-profit or the government. The largest guarantor of private loans was TERI which itself filed for bankruptcy in 2008.

Private student loans do not, unlike many guaranteed student loans (parent plus loans excepted), qualify for current income-based repayment plans. However, the private loans are not collected by the U.S. government. For federal loans (not private loans), including FFEL and Direct loans, the government uses private collection agencies (such as Pioneer Credit Recovery) to collect the defaulter's earnings and other income. Without the government's help in collecting, it's unlikely that a defaulter's social security could be confiscated for a private loan default, making debt relief perhaps less urgent. On the other hand, private student loan bankruptcy should, in theory, cost taxpayers nothing.

With Obama backing bankruptcy for the private loans, U.S. Representative Steve Cohen (D, Tennessee) 5/26/2011 introduced HR 2028 (Private Student Loan Bankruptcy Fairness Act of 2011). This "[a]mends the federal bankruptcy code to remove qualified educational loans as an exception to discharge from bankruptcy." However as the "lame duck" session for the 112th Congress opened (November 14), this bill was in committee, and was not likely to be voted on.

Today: The "Brunner Test"

Whether a judge will agree today with you that your loan should be dischargeable depends on its passing a test, usually the "Brunner Test" for "undue hardship." For your loan to pass this test, your financial future has to appear absolutely hopeless. That is, you must expect to earn no income (be essentially unemployable) for the rest of your life. However if you are permanently completely disabled, your student loan debt can also be cancelled. (Note however that simply being qualified to receive social security disability payments does not qualify you for student loan cancellation; there is a separate procedure for qualifying.)

Student Loan Borrower Assistance provides examples of hardship situations that may qualify a student loan to be dischargeable via bankruptcy. As for asking for a loan to be discharged because of lack of accreditation or because a school program you were enrolled in had but then lost accreditation, you would probably have to be able to prove fraud. Nevertheless, if you want to try this route, you might look at Student Loan Borrower Assistance's sample "Complaint to Determine Dischargeability of Student Loan." However, with the IBR (Income-Based Repayment Plan), many low income borrowers have other options besides bankruptcy, though not of course if they are in default (270 days past due) unless acceptable payment arrangements are made (these will be discussed in a future article), and not for private loans.

Bankruptcy and Credit

Bankruptcies remain on your credit report for ten years. However, if asked if you have ever had a bankruptcy discharge, you must always say "yes." This can affect your eligibility for credit but should not affect your eligibility for jobs since it is no longer legal to deny employment on the basis of a bankruptcy. Also credit checks for employment have been limited by legislatures in several states (Hawaii, Illinois, Oregon, and Washiington).

A bankruptcy is also not listed as a reason for denying security clearance, but some spending habits behind bankruptcies may result in denial of clearance. Background checks for security clearance look at your history for the last ten years.

Sources